Flooding after the Ngaruroro River in Hawke's Bay burst its banks during Cyclone Gabrielle. Photo: Supplied / Dawson Bliss

A new Treasury report says New Zealand's economy as a whole is resilient and well-placed to weather the climate change storm.

However it said the "modest" change predicted to gross GDP in the coming decades masked the huge impact it would have on some sectors and households, and one expert is questioning its conclusions altogether, saying it is radically underestimating the costs.

Cutting emissions to meet New Zealand's climate targets may cause some sectors to shrink or even disappear, particularly those whose only way to reduce emissions is by reducing output.

Agriculture, forestry, fisheries and tourism were particularly exposed, as were the regions where these industries dominate or the places particularly vulnerable to flooding, such as Southland, Tai Rāwhiti, Northland, Waikato and the West Coast.

Poorer people would be disproportionately affected, as would Māori, the report said.

The findings come from the Climate Economic and Fiscal Assessment Assessment 2023 report by Treasury and the Ministry for the Environment.

It is the first time Treasury has done this type of climate report, and combines its own analysis with previously released reports by the Climate Change Commission, consultants and other agencies.

Treasury said modelling of the overall fiscal (government revenue and spending) risk from physical things like storms, flooding and sea level rise was not yet available, but it was likely to be substantial and grow over time.

It said this report was done before Cyclone Gabrielle and other major flooding events this year.

Economy and Crown books 'resilient'

The report said New Zealand was better able to adapt to the impacts of climate change than many other countries because of its strong institutions and track record of economic and fiscal resilience.

It said increased storms and droughts could push up net core Crown debt by 3.77 percent of GDP in 2061. For context, net debt is forecast to peak at 21.4 percent of GDP in 2023/24, and in 2022 the government pledged to keep it below 30 percent.

Treasury's initial modelling shows the impact of increasing droughts would cause GDP to be 0.5 percent lower in 2061, and greater floods and storms would make GDP 0.7 percent lower - not far off the blow to the economy from the 1997/98 drought.

The analysis considers only two specific types of extreme weather events in isolation, and does not include sea level rise or temperature increases.

The impact on GDP from making emissions cuts needed to met climate targets under most scenarios was not expected to be a "material departure from business as usual".

The Climate Change Commission has previously estimated that meeting the emissions reduction targets would result in GDP being 1.2 percent lower in 2050.

It said it would likely also require an extra $38 billion of capital investment.

Who will be most affected?

The report said the "modest" change to GDP levels masks how big an impact it will have on some sectors and households.

Some sectors may shrink or even disappear, particularly those whose only way to reduce emissions is by making or doing less.

Agriculture, forestry, fisheries and tourism are particularly exposed given their direct dependence on climate-sensitive natural resources.

Regions such as Southland, Tai Rāwhiti, Taranaki and the West Coast, whose economies were reliant on emissions-intensive industries (such as agriculture, heavy manufacturing, food manufacturing, and extraction and distribution), would be most affected.

Rising costs of food and fuel driven by the Emissions Trading Scheme were likely to disproportionately affect lower-income households. Māori were especially vulnerable - they are over-represented in lower-income households and are more likely to work in high-emitting sectors.

Households near the coast and in flood plains were at greater risk, and faced paying more for their insurance or not being able to get it at all.

Trying to cut emissions more quickly than currently planned, and the finite amount of land available to plant trees to absorb carbon, were expected to drive greater negative impacts on GDP.

However, the report noted that warmer temperatures may be of some benefit to New Zealand farmers compared to other countries. And it said there were improved health and environment benefits from slashing fossil fuels.

Impact on government's books

The report said the overall direction of impact on fiscal revenue was likely to be negative - from both the physical risk posed by climate change, and because of the possibility of slightly lower economic growth due to the change to a low-emissions economy.

The report said extreme weather events and sea-level rise were expected to present the greatest risks to the value of the physical assets owned by the Crown. These included roads, schools and hospitals, rail assets and electricity infrastructure.

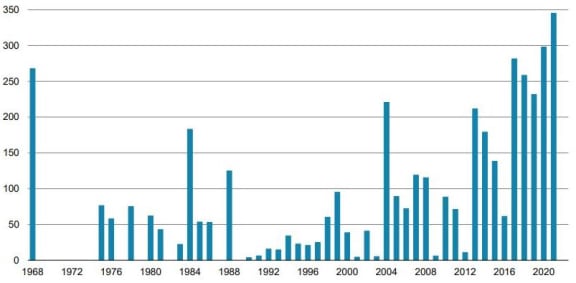

The costs from more frequent and damaging storms were likely to increase over time, expanding New Zealand's already significant natural hazard risk profile.

Modelling showed that sea-level rise of 30cm - expected to occur between 2045 and 2070 - could expose an additional $6b worth of buildings to at least a 1 percent chance of flooding in a given year, beyond the $12.5b exposed at the present sea level.

Other modelling showed that around 10,000 houses could become uninsurable by 2050 because of coastal flooding hazards from sea-level rise.

The government faced having to pay for adaptation measures, possible financial support for people affected by droughts and floods, and increased storms would also expose Crown assets to greater risk.

Indirect fiscal costs were likely to arise due to changes to the tax base. There would be implications for transport-related charges and taxes, and through environmental taxes, including the NZ ETS.

The report cited NZIER research that climate change could cause an increase in the annual growth of the Crown liability for natural hazards from 5.3 percent to up to 5.7 percent through to 2050.

Treasury analysis showed meeting New Zealand's international pledge to cut emissions - called Nationally Determined Contributions, or NDCs - which requires paying other countries to make cuts on our behalf, will cost anywhere from $3.3b to $23.7b by 2030.

'Bit of a stretch'

Professor Ilan Noy, inaugural chair in the economics of disasters and climate change at Victoria University, told RNZ's Morning Report on Tuesday the authors of the report were "undertaking a mission that is almost impossible to do" without crystal balls.

"The tools we have are very, very imperfect, so I think to expect that it will do so accurately is a bit of a stretch. But I think that the report does underestimate some issues, some concerns, and that's what I would emphasise."

The main problem, Noy said, was that New Zealand was hoping to avoid having to eliminate emissions by offsetting them with carbon permits bought on the international market.

"The problem with that is that almost every country in the world has exactly the same plan, so everybody wants to buy emission permits abroad," he explained.

"Now, if everyone buys and no one sells, we have a problem. So we are assuming that there is a mysterious country that will reduce its emissions a lot more than its targets and then sell the extra to all the other countries in the world, but that that mysterious country I don't think exists. No, it's not realistic to expect that we will do that.

"So there are two other the two ways to deal with that. One is to reduce our emission more deeply than that - actually reduce our emissions - or just not achieve the targets that we set ourselves. Neither of these are very appetising, I think."

Ilan Noy Photo: supplied

The cost of purchasing credits could range anywhere between $3 billion and $23 billion, the report said, noting "the future price of international reductions is uncertain". Noy said even the upper figure was not a huge amount to absorb over decades, but " it could be much higher than that, if indeed what I'm saying is right and nobody is going to be selling those or very, very few countries are going to be selling those permits. So I'm not sure that that those numbers are realistic.

"And the problem is, right, if we sort of convince ourselves that it's all manageable and we can buy these credits, then the incentives, the pressure to actually physically cut emissions is potentially reduced."

He said the Treasury report also looks at "various reports and research projects" whose "numbers somehow don't align very well".

"The problem here is this report is relying not on a unified and internally coherent body of research that the Treasury has undertook. It takes various reports and research projects and so forth that have been done over the years and tries to compile them together, but they are not internally consistent with each other."

Nor are up-to-date, he said, relying "heavily on the report from 2018, which looked at the previous decade and unfortunately in the last five years, every single year has broken the record in terms of extreme weather events".

-RNZ