It may be cold comfort for Kiwis but today Australia posted worse inflation than New Zealand’s.

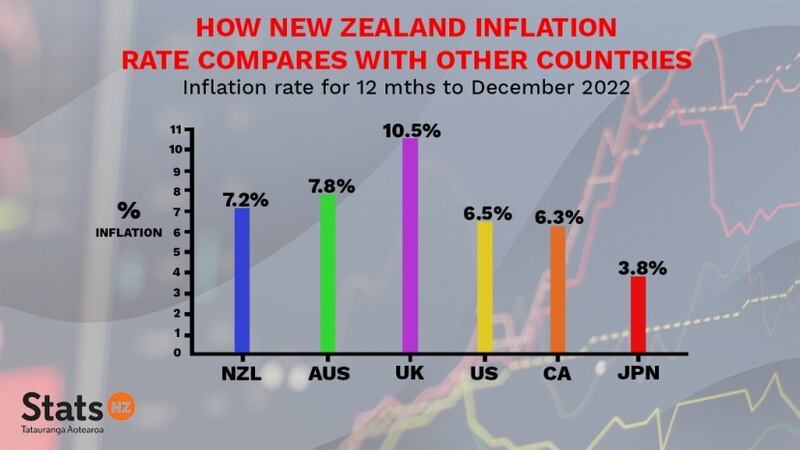

Stats NZ this morning revealed inflation for the 12 months to December had come in at 7.2%, which hasn’t budged since the last quarter.

That high figure may result in the Reserve Bank next month lifting the official cash rate again next month as it tries to punch down inflation but leaving Kiwis struggling with the high cost of living. Housing, food and transport prices were responsible and the monthly food prices series showed annual food price increases were the largest since April 1990 and mainly came as a result of grocery food prices.

This afternoon the Australians revealed their latest figure was 7.8% for the same period.

The high figures got immediate reactions from both governments.

Brand new New Zealand Prime Minister Chris Hipkins immediately announced reprioritising the government’s work was the “absolute priority”. This would allow the government to focus on the cost of living.

Newly sworn-in Prime Minister Chris Hipkins at his first prime ministerial press conference today

No. 1 focus

Hipkins said the cost of living “is the No 1 issue we are facing as a country, and therefore it will be the No 1 focus of the government.”

“Today’s unchanged inflation figure confirms this is the right immediate focus.

“We will do everything we can to bring inflation down in New Zealand. We will also be seeking to support New Zealanders.”

He said one of the pressures New Zealand and Australia were feeling on grocery pressures had to do with the weather.

But he arguedthere was a limited amount that governments could do.

Meanwhile, Australian treasurer Jim Chalmers said the 7.8% figure was “unacceptably high”.

‘Extreme price pressures’

“We are optimistic about the future of our economy and the future of our country. But we are realistic about the extreme price pressures that Australians are facing right now."

Ironically, the latest figure comes as new figures show there was a 32% increase in the total wealth of New Zealanders in 2021, caused by the then housing boom.

Credit Suisse's global wealth report found that wealth per New Zealand adult increased $176,000 in 2021 to $728,000. NZ had the most significant increase on a per-adult basis compared to other countries.

Credit Suisse said the "rapidly rising house prices combined with an appreciating currency" were behind the increase.

But house prices plunged last year by 14% and the New Zealand dollar fell against the US dollar, which means the gains may have been shortlived.

Working people hurting

Meanwhile, the Council of Trade Union’s fifth annual Mood of the Workforce Survey has found working people are bearing the brunt of the cost-of-living crisis with a record three out of four saying their incomes cannot keep up with inflation.

CTU secretary Melissa Ansell-Bridges said the results of the survey raised real concerns about who was paying the price for inflation. “It’s clear that people are hurting and we’re really worried that the traditional policy response of raising the OCR and reducing government spending is only hurting them more.”

Nearly 60% of the 1870 respondents cited rising grocery prices as the biggest pressure on their budgets followed by mortgage and rent (17%) and transport (8%). A majority (61%) believed higher wages were the key to helping them deal with inflation and only 16% thought tax cuts would help.

"We're proposing a long-term solution - the Inflation and Incomes Act - that starts to look at other options to intervene in the economy to fix inflation that will result in better social and economic outcomes.

“There’s no doubt the cost-of-living crisis is going to be a huge election year issue and who actually pays the price for fixing it is the most important question we need to ask ourselves.”

Meanwhile, National’s fnance spokesperson Nicola Willis said inflation had its claws in the New Zealand economy and Kiwis were paying the ever-higher price.

“Alarmingly, this surge is occurring even while inflation eases off around the world, with lower rates of inflation now evident in the US, Japan and Canada and petrol prices falling quicker than many had predicted.

“Inflation now has a tighter grip in New Zealand because of homegrown problems like worker shortages, higher costs for landlords being passed on to tenants, and Labour’s relentless commitment to yet more spending and borrowing..

“Today’s data is bad news for anyone with a mortgage or credit card bill to pay, because it suggests the Reserve Bank will have to keep hiking interest rates to get runaway prices under control.

“National would re-focus the Reserve Bank on price stability, stop adding costs and taxes to businesses, address workforce shortages, bring discipline back to Government borrowing and spending, and help Kiwis adjust to higher prices by letting them keep more of what they earn with a programme of income tax reduction.”