Two of New Zealand’s biggest seafood companies have sailed in different directions after another tough Covid-19 year.

Sanford chairman Sir Rob McLeod told his company’s annual meeting this week that there would not be a 2021 dividend because it was prudent to retain profits on the balance sheet under current conditions.

“We are determined to resume dividend payments as soon as it is feasible,” he said.

However, the largest Māori owned kaimoana and kai ora company, Moana New Zealand was proudly touting it would be paying a $10.8 million dividend despite the challenging conditions, up from $8.8m last year.

Its chair Hinerangi Raumati-Tu’ua said Covid19 continues to be a challenge this year.

“However we have not stopped looking to horizons to seek out opportunities which deliver greatest value to our shareholders.”

Moana NZ reported a net profit after tax of $27 million for the 2021 financial year, up 33% on the 2020 financial result. Operating earnings before tax and interest were up 70% on the previous year.

Both companies’ officials said having a mixed portfolio had got them through the difficulties of the past two years.

Moana's Ika (finfish) division had a good year, finishing up at 98% of its goal, seen as an outstanding effort given labour shortages and volatile markets both at home and overseas.

Moana said divisions continued to be affected by the disruption of global freight (higher costs and disrupted bookings) but demand for its product remained strong.

The company benefited from China’s import restrictions on Australian lobster.

Kōura (lobster) 2021 financial year earnings were $6.4m ahead of estimates, with export pricing remaining strong throughout the year.

Sealord, 50% owned by iwi, also had a solid year, reporting net profit after tax of $31.7 million, 8% ahead of last year.

This came despite restrictions on foreign crew delaying sailings at the beginning of the year.

Earnings before income and tax from both core fishing business and Petuna Aquaculture were ahead of predictions and a “careful focus” on operational detail and sales flexibility helped to navigate through Covid19 challenges.

Moana New Zealand has commissioned a purpose-built tio (oyster) hatchery which is nearing completion. Lockdown restrictions and supply chain delays have meant the first commercial run of spat will be early in 2022. This investment will ensure a continuous supply of spat.

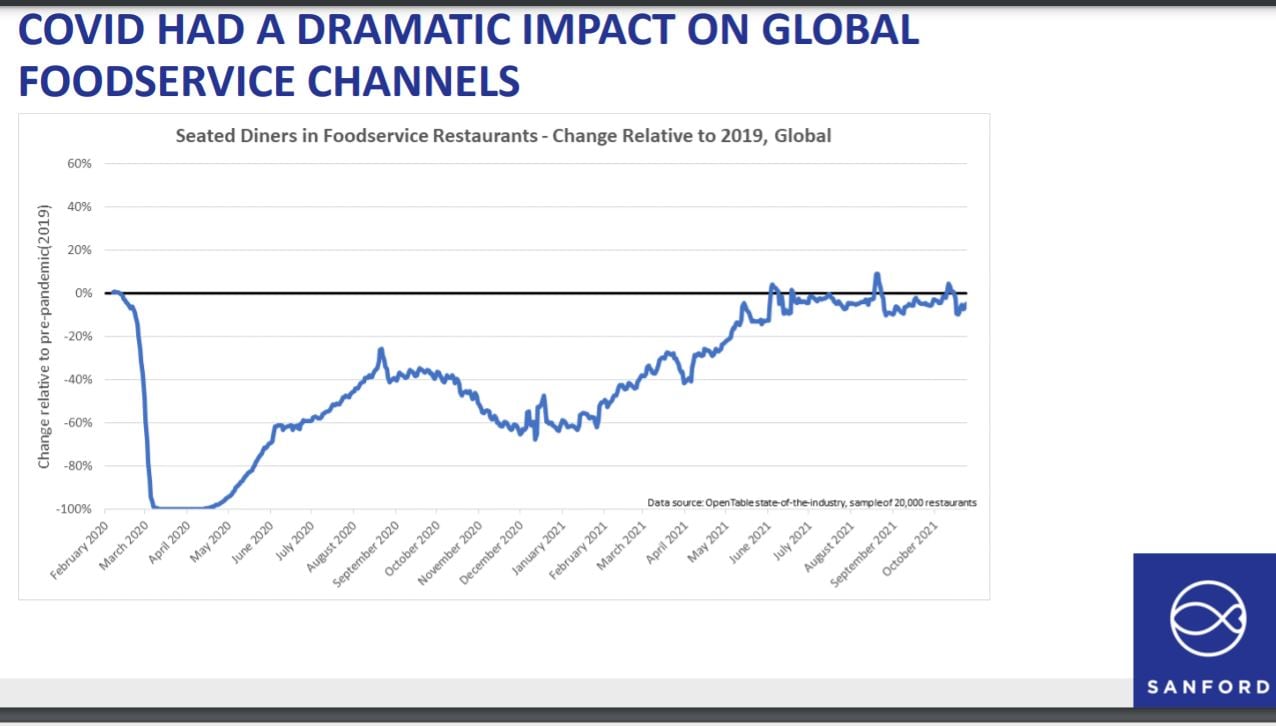

Sanford chair Sir Rob McLeod said the board and management agreed the adverse impact of Covid was waning.

“We believe that demand conditions will return to pre-Covid levels in the classical U or V formation. We do not predict the future format as a W.”

Dormant demand recovering

“We have good reason to predict that market demand will return to its pre-Covid level at a faster rate than new revenue has grown in the past, although not as fast as it declined.”

McLeod said there were signs dormant demand was recovering. “We are well placed to capitalise on that trend – though we are taking nothing for granted.”

Sanford saw an improvement in its adjusted earnings before income and tax (EBIT) as it saw signs of recovery in global markets.

“While our catch and harvest volumes were down (-8.2%), our sales volumes increased by 7.4%. Our sales revenue also increased by 4% to $489.6 million.

However, higher freight costs and supply chain uncertainties eroded margins. Adjusted EBIT for 2021 was $23.3 million, down 39% from the previous year’s $38.3 million. Net profit after tax was $16.2 million, down 16% on the previous 12 months.

Science, not sentiment

Earnings per share were down 3c at 17c.

McLeod saw some clouds on the horizon.

“The government has signalled fisheries reforms. We support moves to protect the health of the marine environment but sustainable management of the oceans must be based on science, not sentiment. Collaboration is working and must be given the chance to continue.

He emphasised that emigrant workers were an important part of Sanford’s workforce in processing and in specialist trades like engineering.

“Policies aiming to reduce reliance on migrant talent need careful thought given the potential for unintended economic and environmental impacts. Labour is already in short supply.”

Sanford chief executive Peter Reidie said the main driver of the poorer performance had been the mussel business. It had limited negative effect in the 2020 year as Sanford continued to fulfil contracted orders at good prices.

“But, due to the frozen nature of these products and the way our contracts are timed, mussels have been more severely impacted in the 2021 year. They have been slower to recover as our customers had to clear the stock they were contracted to buy but had no outlet for during the initial covid lockdowns.

The supply chain team had been constantly challenged with late schedule changes, freight cost increases and capacity constraints. Sanford had also struggled to maintain appropriate manning levels at land-based plants, particularly Havelock and Timaru.

“We have had to address these challenges with moves to the grocery channel and by re-arranging our export freight through Kotahi, New Zealand’s largest supply chain collaboration group, which gives us significantly more scale and greater access.”