With Māori unemployment still standing at over double the Pākehā rate, food banks handing out fewer food parcels as donations drop, and falling retail sales, the Reserve Bank still managed to surprise economists today when it tipped its hat to the cost of living crisis.

It increased the official cash rate, which sets bank interest rates, by only 25 basis points to 5.5%.

Although that should still dampen spending and boost interest rates and rents, it was welcomed by many commentators who had been worried the central bank, Te Pūtea Matua, would boost the OCR by 50 points again, which it did in both December and February, and which led directly to sharp increases in mortgage interest rates and higher rents for housing.

The bank’s monetary policy committee’s minutes reveal it voted on the 25 points rise – or not increasing the OCR at all. The rise won five votes to two.

As always, the commercial banks were watching closely, with ASB Bank promptly upping its housing variable rate from 8.39% to 8.64% while its Orbit home loan rate moved from 8.49% to 8.74%. Other banks are expected to follow in the next few days.

Justifying its restricted increase, the Reserve Bank made a point of saying the level of interest rates was constraining spending and inflation pressure.

It said it was confident that, with interest rates remaining at a restrictive level for some time, consumer price inflation would return to within its target range of 1-3% a year, while supporting maximum sustainable employment.

Budget attacked on both sides

Some concern had been expressed after last week’s ”bits and pieces” government budget, which was widely seen as not helping the Reserve Bank’s mission of getting inflation down.

But it was also criticised for not addressing issues faced by poorer people.

In fact, Massey University’s leading economist, Professor Matt Roskruge (Te Atiawa, Ngāti Tama), noted on budget day that potential help such as removing GST on fresh kai, increasing Working for Families and addressing the mental health crisis were conspicuously absent.

And the latest unemployment figures have shown that, while unemployment is falling overall, with unemployed Pākehā falling from 4% in 2021’s first quarter to 3% in this year’s first quarter, Maori unemployment has fallen at the same time from 8.8% to 7.8% and Pasifika from 10.4% to 5.9%.

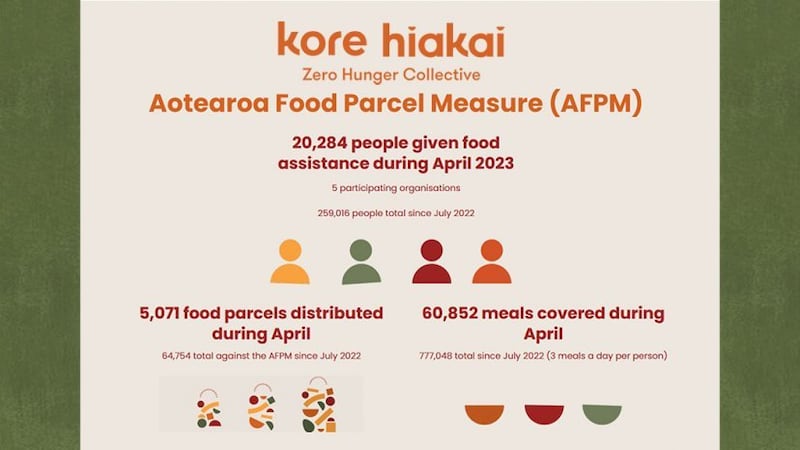

Meanwhile, food banks across the North Island are having difficulty supplying food as donations decrease in the cost of living crisis. The Aotearoa Food Parcel Measure, a visual dashboard which illustrates how many food parcels are being given out and how many people are being fed, shows the number of food parcels distributed in March was 3,422 fewer than at the start of the year.