As the government raises the minimum wage for Aotearoa's poorest workers to $21.20 an hour, its own workers in core state departments are on the living wage at $22.75.

The government will increase the minimum wage from $20 an hour to $21.20 an hour on April 1, giving a 40-hour worker an extra $48 a week or $2500 more a year.

However, the government’s own staff in the core public service are being paid a minimum of the New Zealand living wage rate of $22.75 as their department’s service contracts come up for renewal. That was announced back in November by the Council of Trade Unions.

Today CTU president Richard Wagstaff welcomed the minimum wage increase as making sure “some of the most critical workers during COVID-19 get a fairer deal for their contribution."

But Wagstaff wants the government to go further and bring other workers’ minimum wage in line with the living wage.

The minimum wage increase per hour, which would buy a couple of bananas, neatly matches the 5.9% increase in the price of goods and services in the last three months of 2021 compared to 2021, which has worried many whanau as they shop and buy petrol. That rise was the highest since a 7.6% annual rise in 1990.

Cost of living shoots up

Workplace Relations Minister Michael Wood says the minimum wage rise will directly benefit about 300,000 workers. The starting-out and training minimum wage will also increase from $16 to $16.96 per hour.

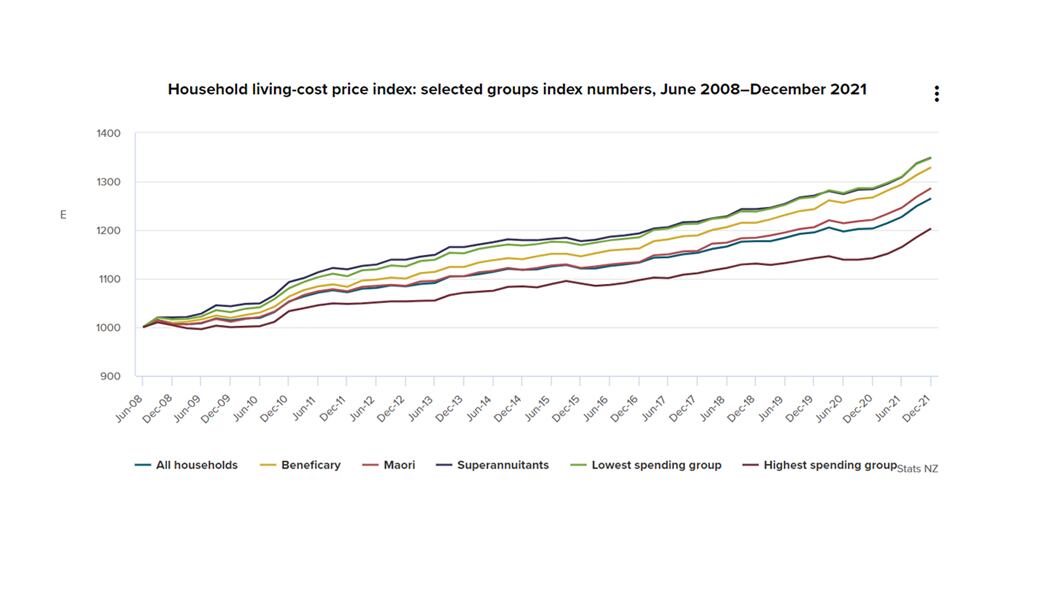

But his announcement came as Statistics NZ found the annual cost of living increase in Aotearoa was the highest recorded since the series began in 2008 for seven out of 13 household groups.

For example, Māori households experienced an annual living-cost increase of 5.3 percent from December 2020 to the December 2021 quarter, compared with the 5.2% of the average household.

This was driven by higher prices for petrol, housing rentals, and mortgage interest payments.

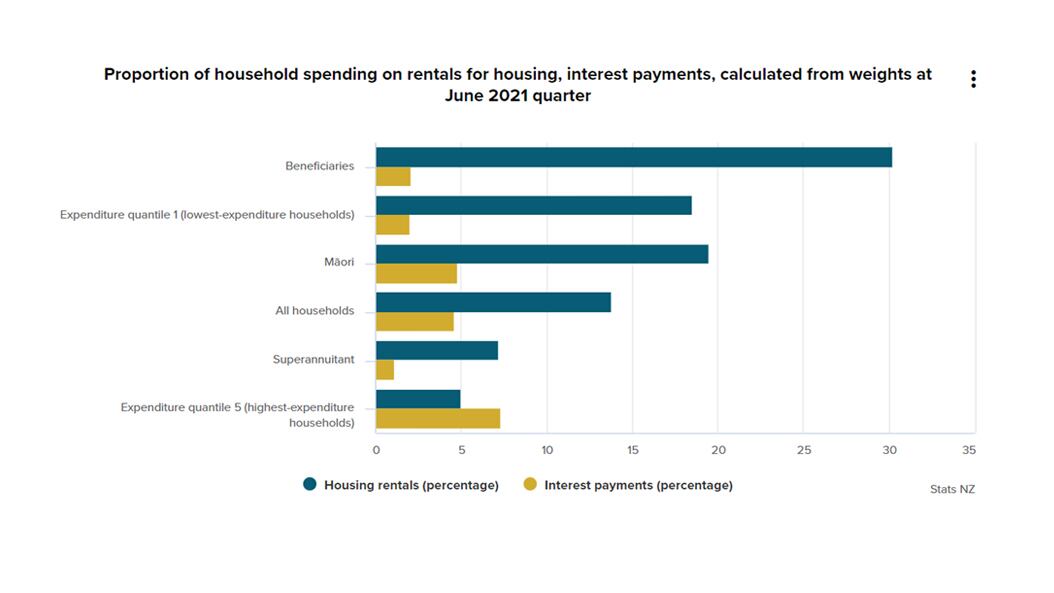

“Māori households spend about 20 percent of their expenditure on rent, compared with about 14 percent for the average household,” StatsNZ consumer prices manager Katrina Dewbery says. “This means that the impact of higher rent prices is felt more by Māori households,” she says.

Less petrol use

Māori households spend a similar proportion of their expenditure on petrol and Interest payments as the average household.

Beneficiary households experienced the lowest annual living-cost inflation of 4.8 percent from December 2020 to the December 2021 quarter.

“Beneficiary households typically spend a smaller proportion of their expenditure on petrol and interest payments when compared to the average household,” Dewbery said.

Beneficiary households spend 2.1 percent of their expenditure on interest payments, compared with 4.6 percent for the average household.

Minister Wood has been arguing that, with the arrival of Omicron, the government is again calling on many of the frontline workers - such as cleaners, supermarket workers, and security guards - to keep the country running as the virus spreads and cases start to increase.

"I think everyone agrees those contributing so much to our Covid-19 response deserve a pay rise,” he says.

‘Stimulatory effect’?

Despite Covid disruption, due to the wage relief and resurgence packages to support people and businesses, the latest statistics show jobs and employment increasing across most sectors, Wood says.

"The wage increase will also have a stimulatory effect on the economy as many workers will spend the extra money on goods and services, which in turn, will help support businesses."

Business organisations today have said they are unconvinced about that and cited the new Matariki holiday and extra five days’ sick leave a year as already having an effect on their revenue.

ACT small business spokesperson Chris Baillie suggests businesses that have already been "decimated" by Covid-19 will struggle to pay for the increase.

Past Ministry of Business research has found "sectors that will experience an impact from a minimum wage increase include hospitality, retail, and administrative services".

MBIE has also warned that the "increased cost of labour may then be passed on to customers through rising prices of goods and services, as employers seek to maintain a profit".

However, "for most businesses and sectors, workers on the minimum wage represent a small fraction of total labour costs so any increase in the minimum wage should not significantly impact overall operation costs".

Baillie said the new Matariki public holiday and five extra days of sick leave will collectively add almost $1.5 billion in costs to businesses and will be passed on to customers. He said Fair Pay Agreements will also add to the pain.

"The only way to sustainably raise wages is to raise worker productivity. Labour doesn't have any serious solutions on that front."